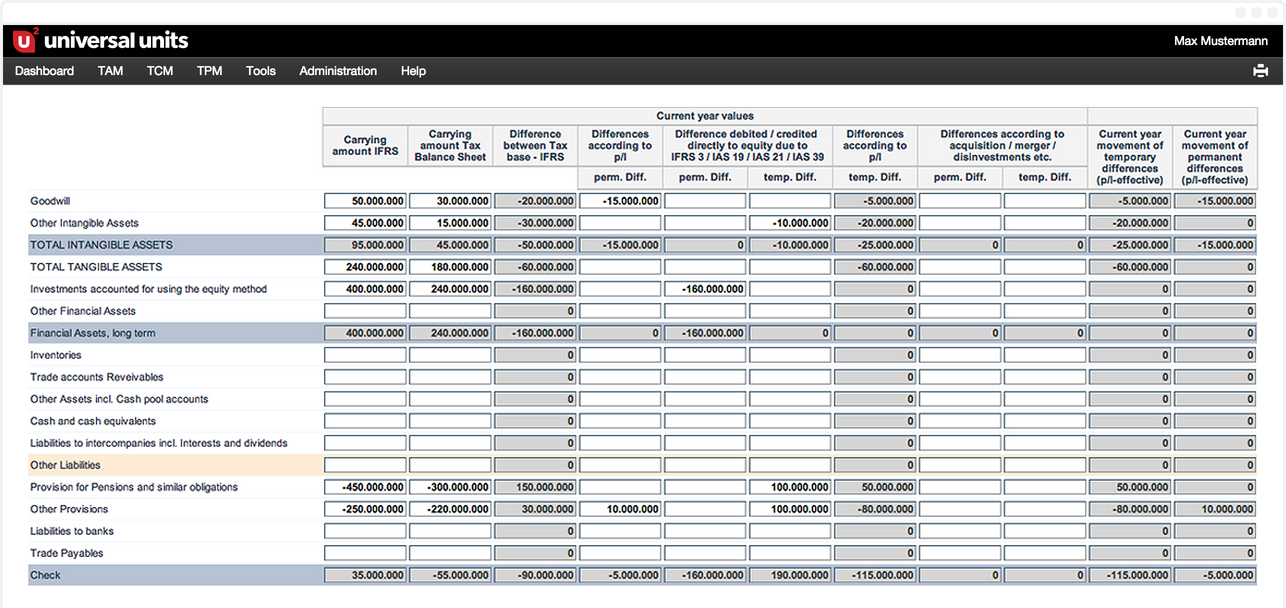

Deferred Tax Management is a module to calculate current taxes, deferred taxes and all data to be provided in the IFRS notes.

The following templates are available for recording or uploading the local GAAP or tax balance sheet values:

- Tax Rates

- Balance Sheet Previous Year / True Up’s

- Balance Sheet Current Year

- Corporation Tax Calculation

- Local / State Tax Calculation

- Current Tax Losses

- Current Tax Positions

- Adjustments on deferred taxes

The calculations are made directly in the templates and they are available through comprehensive analysis reports:

- Deferred Taxes according to the balance sheet

- Income Tax Values (closing balance)

- Effective Tax Rates Analysis (ETR)

- Reconciliation

Features.

- Calculation of current tax, deferred tax and data to be provided in the IFRS appendix

- Calculations can be easily reproduced as the formulas can be displayed

- Automatic netting at the level of the legal company and at group level

- Status Monitor Reporting

- Decentralized recording and multi-level monitoring

- Import of IFRS and tax balance sheet values as CSV upload

- Supporting of groups, sub-groups, tax groups, etc.

- Reporting on group level with drill-down to individual legal entities